Summary

- My 8th investment into commercial litigation crowdfunding has reached finality.

- It has been 1,018 days from the time of an ACH transfer to the distribution.

- The investment has generated a 0.88x MOIC and a (4.41%) IRR.

Key Events

| Date | Cashflows | Description |

|---|---|---|

| Aug 29, 2017 | New Investment Opportunity – $225K | |

| Aug 29, 2017 | Capital Commitment – $170K | |

| Aug 30, 2017 | ($170,000) | Deposit via ACH |

| Sep 13, 2017 | Capital Disbursement | |

| Sep 19, 2019 | Judgement in favor of the plaintiff | |

| Jun 11, 2020 | Distribution of Proceeds via ACH | |

| Jun 12, 2020 | $149,937 | Payment Received |

Funding

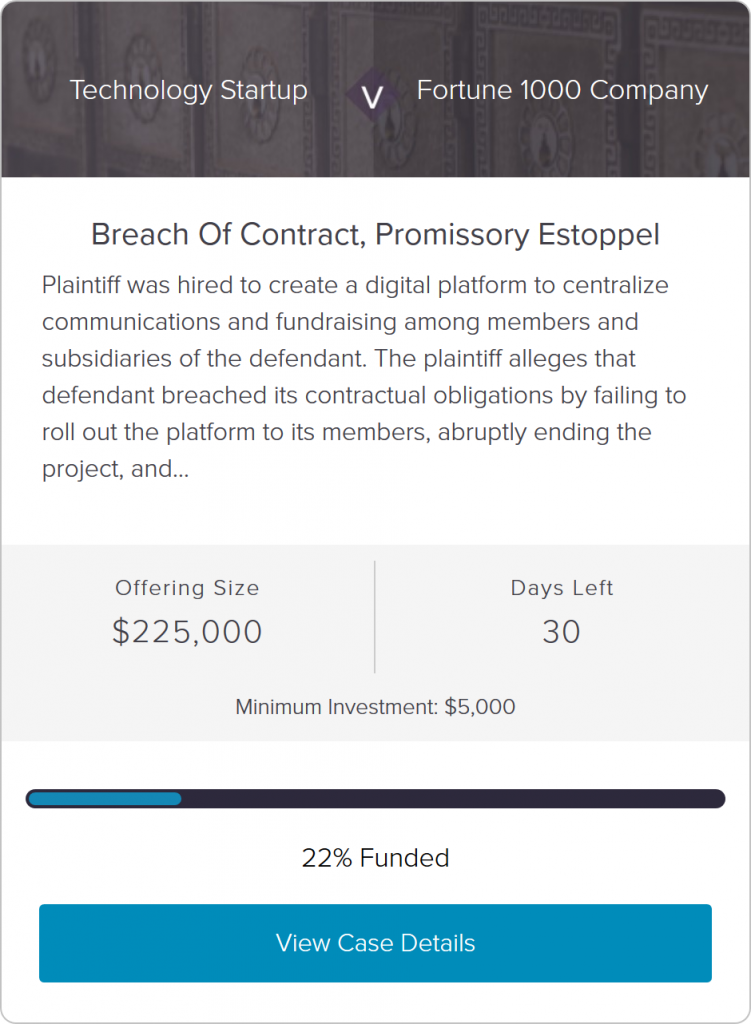

In August 2017, LexShares posted a breach of contract case. My access request was approved very early, but the DocuSign signing process was broken and I was unable to secure my capital commitment. I accidentally put a very large amount of money into this deal because LexShares fixed the problem in the middle of my desperate attempt to get in. As a result, this became a largest single case investment in my portfolio.

Progress

The plaintiff financed additional $150,000 in April 2018 (fund-only deal), $350,000 in March 2019, and $200,000 in August 2019 (fund-only deal). Additional funding is usually a positive sign that the case on the merits is in good standing. A judge denied both a motion to dismiss and a motion for summary judgment following completion of the second incremental funding.

Resolution

After 2 weeks of testimony, a federal jury returned a verdict in favor of the plaintiff, but jurors awarded far less than the $100 million its lawsuit petitioned for. Adding prejudgment interest, post-judgment interest, and tax costs on damages to the total recovery, the amount was still not enough to cover the principal invested across 4 fundraising rounds. LexShares distributed a $149,937 return via ACH for my investment. Net loss was $20,063 over 1,018 days, for a gross multiple of invested capital (MOIC) of 0.88x and an internal rate of return (IRR) of -4.41%.