Summary

- My 5th investment into commercial litigation crowdfunding has reached finality.

- It has been 682 days from the time of an ACH transfer to the distribution.

- The investment has generated a 2.57x MOIC and a 65.57% IRR.

Key Events

| Date | Cashflows | Description |

|---|---|---|

| Jun 8, 2017 | New Investment Opportunity – $100K | |

| Jun 8, 2017 | Capital Commitment – $25K | |

| Jun 12, 2017 | ($25,000) | Deposit via ACH |

| Jun 16, 2017 | Capital Disbursement | |

| Apr 24, 2019 | Settlement | |

| Apr 24, 2019 | Distribution of Proceeds via ACH | |

| Apr 25, 2019 | $64,135 | Payment Received |

Funding

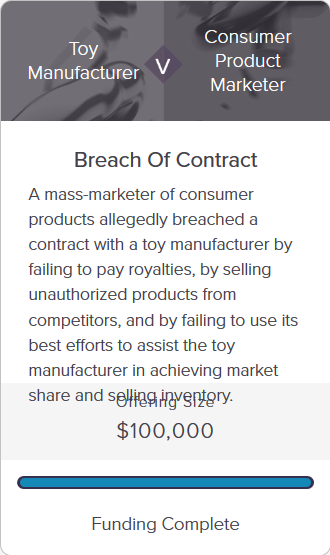

In June 2017, LexShares posted a breach of contract case. LexShares did not send me a notification for this offering. I happened to find while browsing their case portfolio. By the time my access request was granted, there was only 25% left for the total funding amount of $100,000. I committed the remaining amount and closed the deal.

Progress

This offering was for a follow-on funding. The plaintiff raised $120,000 through LexShares back in September 2016. Additional funding is a good sign that the case on the merits is in good standing.

Resolution

The parties had reached a settlement right before going to trial, which was set for May 1, 2019. LexShares distributed a $64,135.40 return via ACH for my investment. Net profit was $39,135.40 over 682 days, for a gross multiple of invested capital (MOIC) of 2.57x and an internal rate of return (IRR) of 65.57%.