Summary

- My 3rd investment into commercial litigation crowdfunding has reached finality.

- It has been 1,079 days from the time of an ACH transfer to write-off.

- The investment has lost the entire principal.

Key Events

| Date | Cashflows | Description |

|---|---|---|

| Apr 13, 2017 | New Investment Opportunity – $225K | |

| Apr 13, 2017 | Capital Commitment – $50K | |

| Apr 18, 2017 | ($50,000) | Deposit via ACH |

| Apr 28, 2017 | Capital Disbursement | |

| Dec 28, 2018 | Judgement in favor of the defendant | |

| May 17, 2019 | Notice of Appeal | |

| Dec 11, 2019 | Dismissal of Appeal | |

| Mar 31, 2020 | Write-Off |

Funding

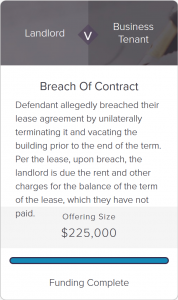

In April 2017, LexShares posted a breach of contract case. I scheduled recurring redemption from a hedge fund to invest a larger amount starting this month. My plan was to withdraw $100,000 every month and reinvest into a single-case litigation over a 6-month period. In order to absorb my cash flow, I had to gain access to 2 cases per month and invest $50,000 in each case.

Progress

At the end of 2018, the judge made a decision in favor of defendant. The plaintiff filed a motion for post-trial relief, but the motion was later denied. The plaintiff then filed a notice of appeal to start an appeal in May 2019. Something might have happened in the appeal process. In August 2019, plaintiff’s trial counsel walked away from the case, and the plaintiff was unable to substitute appellate counsel. The appeal was eventually dismissed for failure to obtain counsel and have counsel enter an appearance on behalf of Appellant within 21 days.

Resolution

LexShares wrote-off the entire investment at the end of the first quarter of 2020. I ended up losing my entire investment.